Choose vet fee cover from £1,000 to £15,000 to suit your pet’s needs. Your limit resets each year you renew.

Ready to feel the wind in your fur and be confident that you understand the world of pet insurance? We’re here to break down the ins and outs of lifetime pet insurance, including what it is and how it works.

Up to £15,000 vet fees

Choose vet fee cover from £1,000 to £15,000 to suit your pet’s needs. Your limit resets each year you renew.

More info

Choose vet fee cover from £1,000 to £15,000 to suit your pet’s needs. Your limit resets each year you renew.

Tailored pet insurance

Your pet is unique. Choose your limits, excess and optional extras to create a policy that fits them like a collar.

More info

Your pet is unique. Choose your limits, excess and optional extras to create a policy that fits them like a collar.

Switch with continuous cover

Switch to Petgevity on a like for like basis, with no gap in cover, and your cover could start immediately**.

More info

Switch to Petgevity on a like for like basis, with no gap in cover, and your cover could start immediately**.

Up to £15,000 vet fees

More info

Tailored pet insurance

More info

Your pet is unique. Choose your limits, excess and optional extras to create a policy that fits them like a collar.

Switch with continuous cover

More info

Switch to Petgevity on a like for like basis, with no gap in cover, and your cover could start immediately**.

In a nutshell, ‘lifetime’ is a term used to describe how vet fees work for a type of pet insurance policy.

Should your pet develop an illness or condition, you can keep claiming as long as you renew each year. That’s why having a lifetime policy gives you the reassurance that your pet could be covered for life.

We believe that cats and dogs deserve the best and you deserve peace of mind. It’s why we only offer lifetime pet insurance, as it’s the most comprehensive type of cover out there.

It’s important to know that a lifetime policy doesn’t mean the price will stay the same over the life of your pet. The cost of their cover can still change each year and tends to go up as your pet gets older.

And not all lifetime policies are the same. Some providers use the term ‘annual limit’ and can offer policies with two types of limits:

- An overall yearly limit

- A yearly condition limit that pays up to a certain amount for each condition each policy year that you renew

To keep things easy, Petgevity policies have just one overall limit that resets annually. You can claim for as many conditions as needed up to your chosen vet fee limit.

Although many vets don’t charge a fee to register your pet, this is down to the individual practice. If in doubt, get in touch with your local vet practice or have a look at their website.

Understanding how lifetime pet insurance works doesn’t need to drive you barking mad.

To make things easier, let’s break down the process further.

- Choose an annual vet fee cover limit that suits you and your pet’s needs. If optional, decide if you’d like to pay towards the cost of a claim by adding an excess or bill share.

- If your pet gets injured or falls ill and you need to claim, the cost will be taken from your annual limit. Claim as many times as needed for as many conditions up to your chosen annual limit each policy year.

- When you renew your policy, your chosen annual vet fee limit will renew back up to the full amount.

A few other need-to-knows about how lifetime pet insurance works

Find out whether there’s an excess for every condition you claim for each year, or whether you only need to pay the excess once in a policy year.

> Check whether you’ll need to pay anything towards the cost of a claim through an excess or co-payment. Some providers make these compulsory, but not with a Petgevity lifetime policy.

> See if the provider will cover pre-existing conditions – but more on that later.

Petgevity considers all pet pre-existing conditions. When getting a quote, you’ll be asked about your pet’s health to see if we can cover them.

Sadly, not all lifetime pet insurance policies cover pre-existing conditions. This is dependent on the provider.

If an insurer does offer pre-existing conditions cover, remember to read their policy wording. Insurers may have their own definition of what is considered a pre-existing condition. This includes what conditions they’ll cover, whether there are any extra excesses to pay or any other limits to your cover.

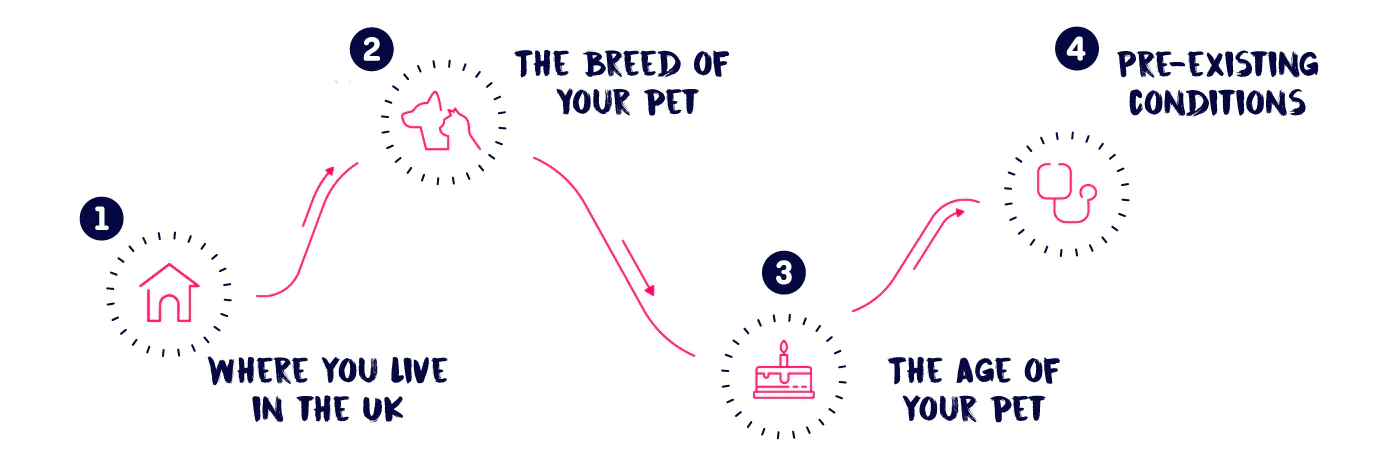

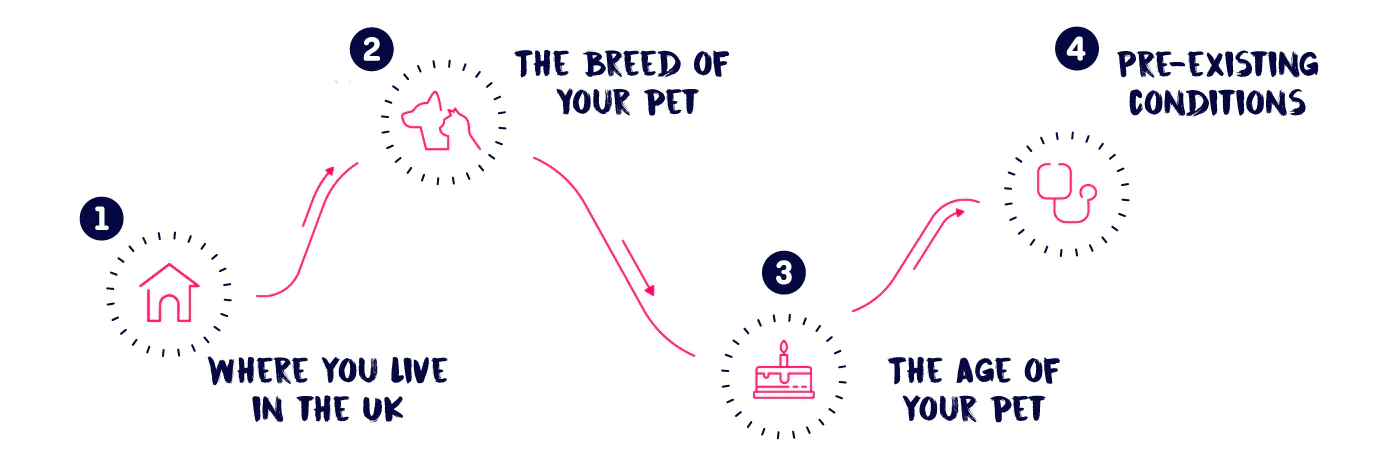

The exact cost of lifetime pet insurance depends on your dog or cat. Different things may affect how much you pay, including:

- Where you live in the UK

- The breed of your pet

- The age of your pet

- Pre-existing conditions (if they can be covered)

You could also end up paying more for lifetime pet cover than other types of pet insurance options. This is because it’s the most comprehensive type of cover. You also have the choice between paying off the policy in one go or spreading out the cost monthly, which may help to make it more manageable.

You might think it’s easiest to jump to the cheapest option when it comes to choosing pet insurance. Before doing this, you may want to take a step back and consider what is right for your pet and their specific needs, and if your chosen policy meets these needs.

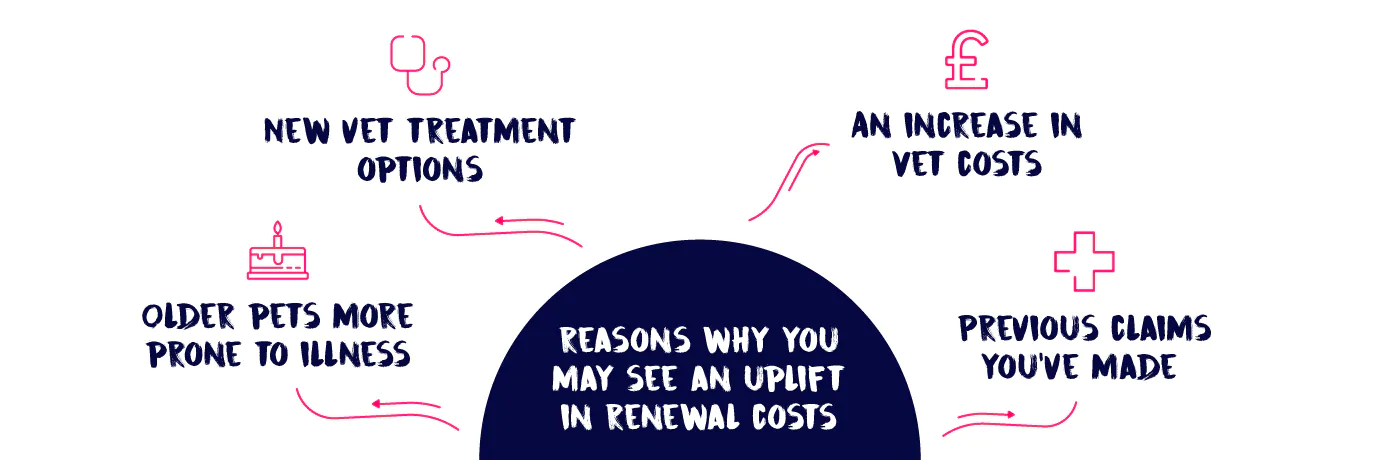

The monthly cost of lifetime pet insurance could go up each year. This may get your hackles up, but there’s several reasons why you may see an uplift in renewal costs:

- As your pet ages, there’s a higher chance of illness

- The introduction of new and sophisticated treatments

- An increase in veterinary costs in your area

- Previous claims made on your pet’s insurance policy

Remember, you’re paying to cover the risk of something happening to your pet in the next year. With time, the risk changes, and so the monthly premium will also change to reflect this.

Lifetime pet insurance has a vet fee limit that resets each year you renew the policy.

Then there’s products like time-limited and maximum benefit pet insurance. These cheaper policies may have a time limit on how long you can claim for new conditions. Or only cover new conditions up to a certain vet fee limit. So it can get confusing as to when and by how much you can claim.

Want a detailed breakdown of the difference between maximum benefit, time-limited, and lifetime pet insurance? Have a read of our blog on how to choose the best pet insurance for your pet.

Only you can decide whether lifetime pet insurance is worth it for your pet. For many owners, not having to compromise on the health and wellbeing of their cat or dog is priceless.

And having pet insurance with a vet fee limit that refreshes each year could give you peace of mind. Your pet can continue to be covered throughout their lifetime for accidents, short-term illnesses, and ongoing conditions.

While there’s lots of positive reasons to pick lifetime pet insurance, think about taking the time to research other types of pet insurance available. You’ll then hopefully have all the info you need to decide what’s best for your pet.

What’s included in a Petgevity policy

Choosing Petgevity to protect your pet gives you more than just vet fee cover. Here's what you get from our policy.

Dental accident

If your pets have a dental accident or injury, you’re covered up to your chosen vet fee limit. Just make sure you’re taking them for annual check-ups and following vet dental advice.

More info

If your pets have a dental accident or injury, you’re covered up to your chosen vet fee limit. Just make sure you’re taking them for annual check-ups and following vet dental advice.

Behavioural treatment

Get expert help with your pets’ emotional and mental well-being, as advised by a vet. Covers up to your chosen vet fee limit (maximum 12 sessions, combined with complementary therapy).

More info

Get expert help with your pets’ emotional and mental well-being, as advised by a vet. Covers up to your chosen vet fee limit (maximum 12 sessions, combined with complementary therapy).

Complementary therapy

This includes alternative treatments like hydrotherapy or acupuncture, as advised by a vet. Cover up to your chosen vet fee limit (maximum 12 sessions combined with behavioural treatment)

More info

This includes alternative treatments like hydrotherapy or acupuncture, as advised by a vet. Cover up to your chosen vet fee limit (maximum 12 sessions combined with behavioural treatment)

Emergency care

If you have an emergency (like an unplanned hospital visit) and can’t look after your pets, you get up to £1,500 towards pet minding costs.

More info

If you have an emergency (like an unplanned hospital visit) and can’t look after your pets, you get up to £1,500 towards pet minding costs.

Third-party liability for dogs

This is when your dog causes injury to someone or their pet, or causes loss or damage to another person’s property. Cover for up to £2,000,000 for legal action made against you or your dog.

More info

This is when your dog causes injury to someone or their pet, or causes loss or damage to another person’s property. Cover for up to £2,000,000 for legal action made against you or your dog.

Choice of optional extras

Choose from a range of optional extras to suit your pets’ needs, such as dental illness and cover if your pets get lost or stolen.

More info

Choose from a range of optional extras to suit your pets’ needs, such as dental illness and cover if your pets get lost or stolen.

Dental accident

More infoIf your pets have a dental accident or injury, you’re covered up to your chosen vet fee limit. Just make sure you’re taking them for annual check-ups and following vet dental advice.

Behavioural treatment

More infoGet expert help with your pets’ emotional and mental well-being, as advised by a vet. Covers up to your chosen vet fee limit (maximum 12 sessions, combined with complementary therapy).

Complementary therapy

More infoThis includes alternative treatments like hydrotherapy or acupuncture, as advised by a vet. Cover up to your chosen vet fee limit (maximum 12 sessions combined with behavioural treatment)

Emergency care

More infoIf you have an emergency (like an unplanned hospital visit) and can’t look after your pets, you get up to £1,500 towards pet minding costs.

Third-party liability for dogs

More infoThis is when your dog causes injury to someone or their pet, or causes loss or damage to another person’s property. Cover for up to £2,000,000 for legal action made against you or your dog.

Choice of optional extras

More infoChoose from a range of optional extras to suit your pets’ needs, such as dental illness and cover if your pets get lost or stolen.

*Cover for pre-existing medical conditions is subject to acceptance. They will not be covered unless you have declared them and they are shown on your Confirmation of Cover.

**Illnesses and symptoms won’t be covered in the first 14 days and accidents won’t be covered in the first 2 days of the policy. This is unless you are switching from another lifetime pet insurance product with no break in cover and the claim you want to make would have been covered by your previous policy. Other exclusions may apply to other sections.